Starting a business is easy. You can register with the state and federal government, do your own bookkeeping and pay taxes on time—all while running yourself ragged trying to drum up new clients.

The more complicated part? Getting your company licensed and legally in order, it doesn’t have to be that hard, and this includes various things like creating an original business logo, patenting materials exclusive to your business, handling taxes and other legal fees, and many more!

So how can you get started, and how to get a small business license in LA?

We’ll show you how to get everything taken care of yourself or let a service like Incfile handle all the paperwork for you so you can focus on what really matters: making money!

Do a business name search for your small business license

Before you choose a name for your business, it’s important to do a search to make sure that no one else has already taken it. You can do this by searching the state’s database of registered businesses and trademarks or checking with your city clerk to see if they have any information on local businesses (although most cities don’t keep records of individual companies).

You should also check to see if there are other businesses in your area using similar names so customers don’t get confused about which business they’re calling when looking at their phone book listings.

For example, if there is already an auto mechanic named “Larry’s Auto Repair” in Los Angeles County but not yet one named “Louie’s Auto Repair,” then Louie might want to add his own unique spin on his shop’s branding so people don’t confuse him for Larry!

There are a few tips to consider like the domain availability, shortness, uniqueness, and future business expansion in our previous blog.

Get a tax registration certificate.

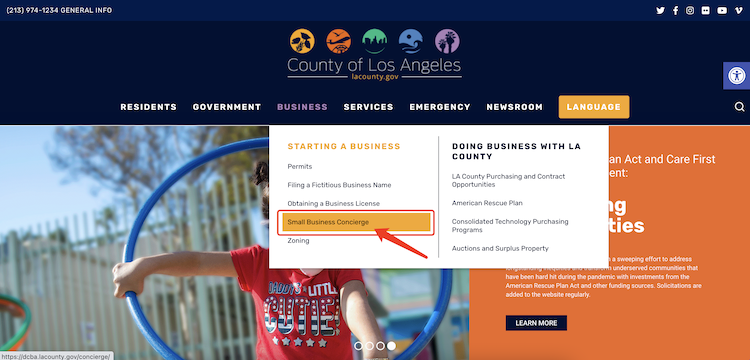

In order to get a tax registration certificate, you will need to apply through LACounty.gov. You can do this online or by mailing in a form. Once your application has been approved, your business will be able to receive state and local business licenses, as well as operate legally within California.

To obtain a Tax Registration Certificate for small businesses in Los Angeles County:

- Go to https://lacounty.gov/ and choose the option for small businesses

- Select the type of business you are starting (for example, a retail store)

- Choose the “Tax Registration Certificate” option from the dropdown menu on the left side of the page

- Submit it when complete

File to become a limited liability company (LLC).

Now that you’ve decided on a business structure, it’s time to file the paperwork. The LLC is a popular choice for small businesses because it offers greater flexibility and lower start-up costs than other business structures. It also allows you to choose how your liability will be shared (called “membership interests”), which can help protect your assets in case of lawsuits.

Many experts consider an LLC to be one of the easiest companies to form because there are fewer federal and state regulations involved than with some other types of companies. In addition, setting up an LLC requires less paperwork than other types of businesses do—you’ll only need one member or manager instead of multiple directors who serve as officers at larger corporations as corporations or partnerships do. Moreover, drafting an operating agreement, though recommended for clarifying internal operations and member responsibilities, is not mandatory in many jurisdictions for forming an LLC.

This makes filing fees much lower than those associated with forming other legal entities such as corporations or partnerships (the cost per member/manager ranges from $150 to $300 a month depending on where you live).

In addition, if you have employees working under your business name then having an LLC protects them from being personally liable for any possible issues related back to their employer company itself.

It’s a double-layer shield barrier exists between both parties (the owner), which gives each party its own set boundaries when dealing with their respective responsibilities towards each other without getting tangled up together during financial matters such as taxes owed versus tax credits available etcetera…

Get a federal employer identification number (EIN).

To apply for a license, you’ll need to find an EIN. An EIN is a nine-digit number issued by the IRS that identifies your business and allows you to file taxes. You can get one online or over the phone by calling (800) 829-4933 between 7:00 am and 7:00 pm on weekdays. It’s free and takes just a few minutes.

You will not be able to open up shop without this number—so you must get one as soon as possible to avoid any delays in getting started!

How to register for business licenses?

Once you’ve decided to start a business in LA, the first thing you should do is contact your local government to find out what licenses you need. The types of licenses that apply to your business will depend on what type of company you are operating and how large it is.

You can ask for an initial consultation with a lawyer or tax expert specializing in small business registration. They can help guide you through registering for a business license, tax registration certificate, and becoming an LLC in LA in compliance with California LLC regulations.

There are also two other important steps: filing to become an employer by getting a federal employer identification number (EIN), which allows them to pay taxes on behalf of their employees, and filing for unemployment insurance if they hire anyone full-time.

Common local permits you might need

If you’re going to be operating a food business, you’ll need a health department permit. If your property is located within the city limits of Los Angeles, you’ll also need a building permit. If it’s in an unincorporated area, there may not be any zoning regulations for small businesses like yours—but it’s still important to check with your local government about what requirements apply to small businesses in general and yours specifically.

You can do a lot of this yourself, but you’ll save time and money by using an online service like Incfile to make it happen for you.

When it comes to applying for a small business license, you can do it yourself or you can pay a service like Incfile to help make it happen for you. We recommend the latter option since it simplifies the process and saves time and money.

This is especially true if you’ve never applied for a business license before. If this is your first time applying, Incfile will guide you through the process step-by-step so there’s no confusion about what needs to be done next—or how much it costs.

So there you have it!

That’s how to get a small business license in LA. Next step is to design a new logo for your business. Get it with an AI logo generator in just a few minutes, and this helps you to ease your mind after a long process of business license application.

Then, go forth and conquer the world!